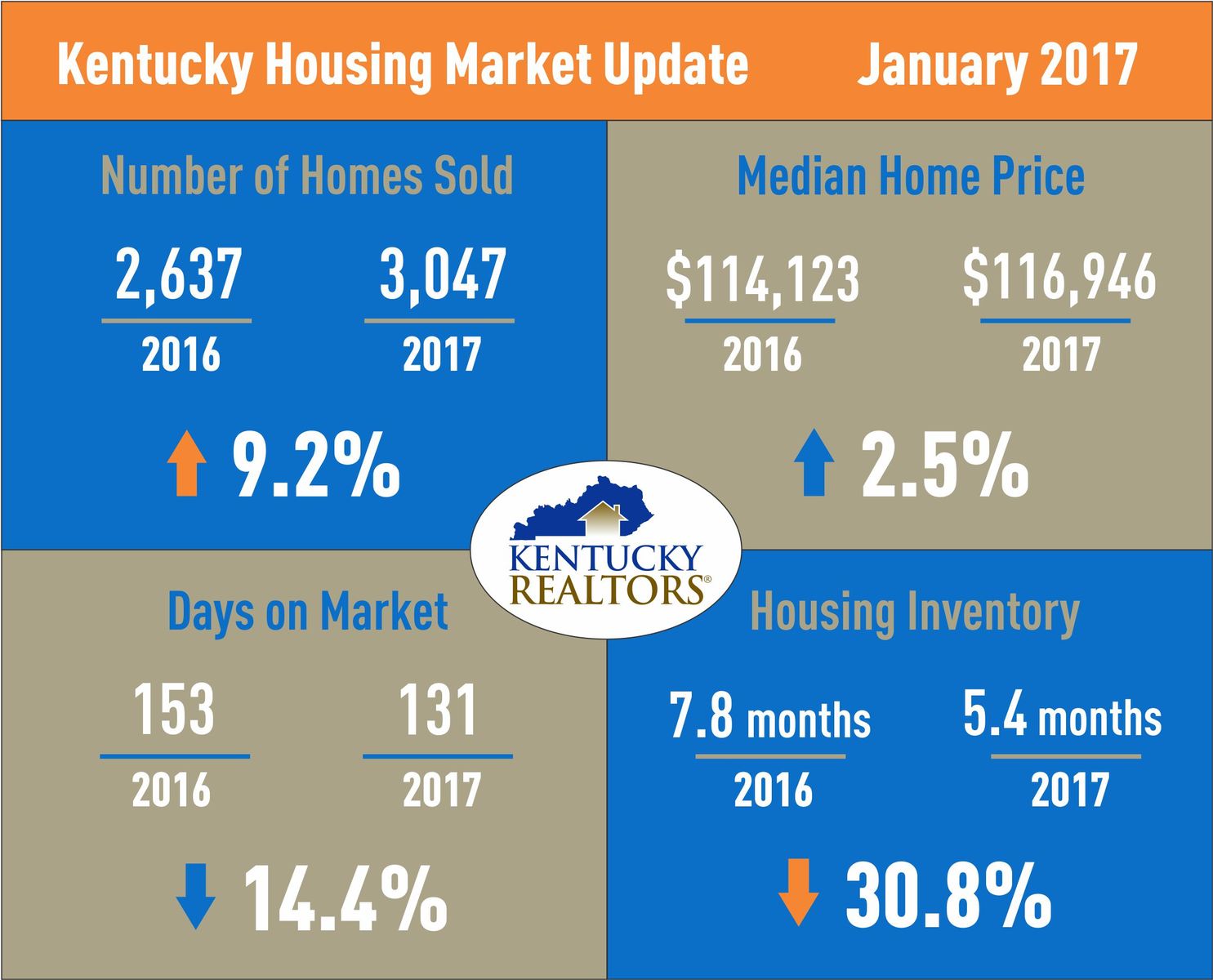

Coming off a strong 2016, Kentucky real estate continued its momentum in 2017 as January saw home sales break the 3,000-unit mark, a new high for the month. The 9 percent gain (3,047 in 2017 versus 2,637 in 2016) follows the national trend where housing increased at its fastest pace in almost a decade.

Coming off a strong 2016, Kentucky real estate continued its momentum in 2017 as January saw home sales break the 3,000-unit mark, a new high for the month. The 9 percent gain (3,047 in 2017 versus 2,637 in 2016) follows the national trend where housing increased at its fastest pace in almost a decade.

The median price rose 2.5 percent in January to $116,946, up from $114,123 a year prior. In Kentucky, median home prices have increased monthly, year-over-year, in 54 of the previous 61 months. Nationally, prices rose considerably in January as it marked the 59th consecutive month of year-over-year gains.

“Kentucky is still seeing a shortage of inventory, and if the economy continues to improve, more buyers are going to be in the market as the spring selling season approaches,” stated Mike Becker, 2017 president of Kentucky REALTORS®. “Affordability in the state makes it easier to purchase a home, however, there just aren’t enough properties available to meet the current demand, especially for the first-time buyer.”

Inventory levels were down over 30 percent in January compared to the same period a year earlier and days on market were down 14 percent. The housing market continues to struggle with available homes even as consumer confidence soared to its highest level in the history of NAR’s quarterly Housing Opportunities and Market Experience (HOME) survey.

Lawrence Yun, chief economist for the National Association of REALTORS, said “the housing market is off to a prosperous start as homebuyers staved off inventory levels that are far from adequate.” He continued by saying “competition is likely to heat up even more heading into the spring for house hunters looking for homes in the lower and mid-market price range.”

With the recent spike in consumer confidence and the number of households that believe now is a good time to buy a home, competition in the housing market may, in fact, remain strong for several months. The recent decision for the Federal Reserve to raise its key interest rate and the indication that two additional increases are likely to occur later in 2017, buyers may be even more eager to jump into the market before the spring season ends. Mortgage rates have inched up over the previous months in anticipation of the Fed increase, averaging over 4 percent in February from a near record low of under 3.5 percent last summer.

“Buyers who are qualified to purchase may want to consider getting into the market sooner rather than later as financing conditions may change going forward,” stated Becker. “Inventory shortages aren’t going to significantly improve which means buyers may also have to search longer than expected to find a home that suits their needs.”

Kentucky REALTORS® is one of the largest and most influential associations in Kentucky. Founded in 1922, Kentucky REALTORS® represents more than 10,300 REALTORS® who are involved in all aspects of real estate, including residential and commercial real estate brokers, sales agents, developers, builders, property managers, office managers, appraisers and auctioneers.

To view housing statistics for the state, as reported to Kentucky REALTORS®, visit housingstats.kyrealtors.com.