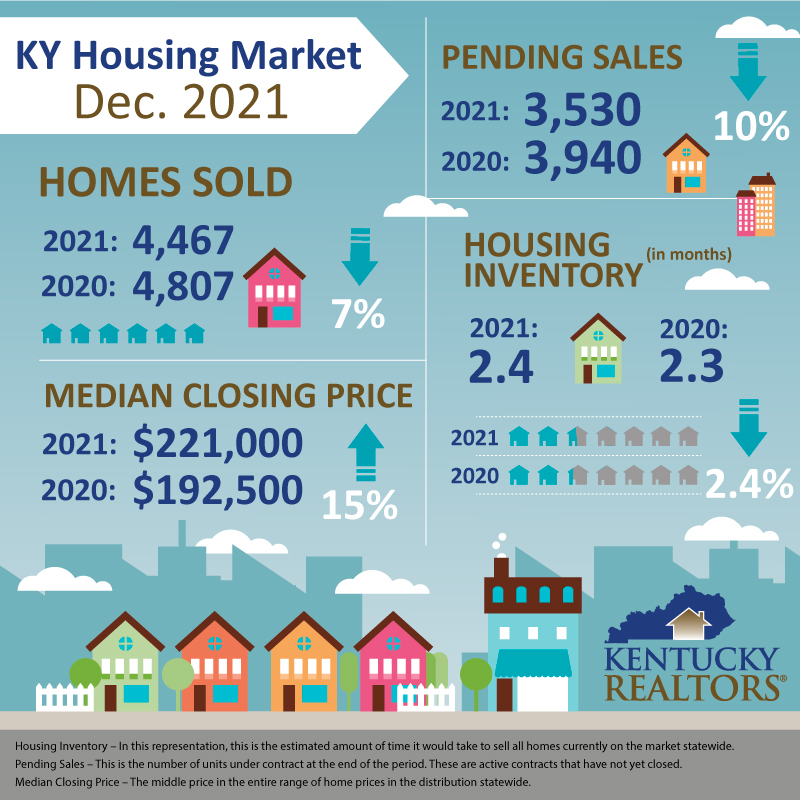

The latter half of 2021 showed signs of a cooling housing market. Units sold numbers were down year-over-year for July through December. They were not down enough, however, to keep 2021 from breaking records across the board. Year-over-year December home sales dropped by 7%, to 4,467 (from 4,807). This bumped the grand total for homes sold to 57,140. This is an increase of 3% from 2020’s tally of 55,507. Kentucky topped the 50,000 mark for the very first time just 2 years ago (2019) when sales peaked at 50,891.

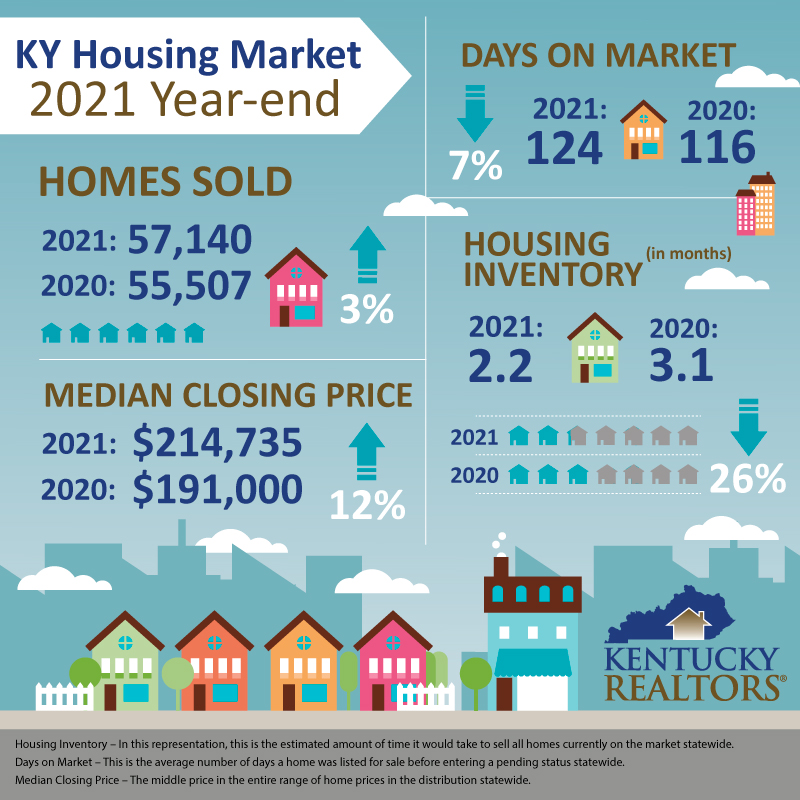

The latter half of 2021 showed signs of a cooling housing market. Units sold numbers were down year-over-year for July through December. They were not down enough, however, to keep 2021 from breaking records across the board. Year-over-year December home sales dropped by 7%, to 4,467 (from 4,807). This bumped the grand total for homes sold to 57,140. This is an increase of 3% from 2020’s tally of 55,507. Kentucky topped the 50,000 mark for the very first time just 2 years ago (2019) when sales peaked at 50,891.

Sales volume broke records once again in 2021 totaling $14.3 billion. This is almost 16% over the 2020 year-to-date volume of $12.4 billion. This figure has essentially doubled over the past 5 years having reached $7.9 billion in 2016.

Nationally, sales seem to be slowing at about the same pace being experienced here in the Commonwealth. “Pending home sales faded toward the end of 2021, as a diminished housing supply offered consumers very few options,” said Lawrence Yun, NAR’s chief economist. “Mortgage rates have climbed steadily the last several weeks, which unfortunately will ultimately push aside marginal buyers.”

Even with December’s slowdown in transactions, Yun says last year was an overall great period for housing in terms of sales and price appreciation. “The market will likely endure a minor reduction in sales as mortgage rates continue to edge higher,” he added. Yun forecasts the 30-year fixed mortgage rate to jump to 3.9% by the fourth quarter and existing-home sales to dip by 2.8% to 5.95 million units.

The median sale price of homes in Kentucky surged about 15% to $221,000. This is just shy of the high-water mark reached in July and November of this year. The average price of homes sold in the Bluegrass state in December crested at $261,252. This pulled the 2021 average price just north of $250,000. This is a record-high and up 12.5% from last year’s high of $223,000.

The median sale price of homes in Kentucky surged about 15% to $221,000. This is just shy of the high-water mark reached in July and November of this year. The average price of homes sold in the Bluegrass state in December crested at $261,252. This pulled the 2021 average price just north of $250,000. This is a record-high and up 12.5% from last year’s high of $223,000.

The recent surge in home prices is good news for those who have owned their home for a few years. “A shot of home equity is a fitting reward for those who worked to acquire private property”, said Kentucky REALTORS® President Mike Inman. “While this doesn’t necessarily mean more money in your paycheck, it is a key factor in wealth-building and the cornerstone of how families pass their wealth down to future generations.”

Pending sales in December were down 10%, indicating that the housing market is continuing its gradual slowing. It is hoped that new construction in 2022, along with a natural slowdown in sales activity, will help boost housing inventory numbers.