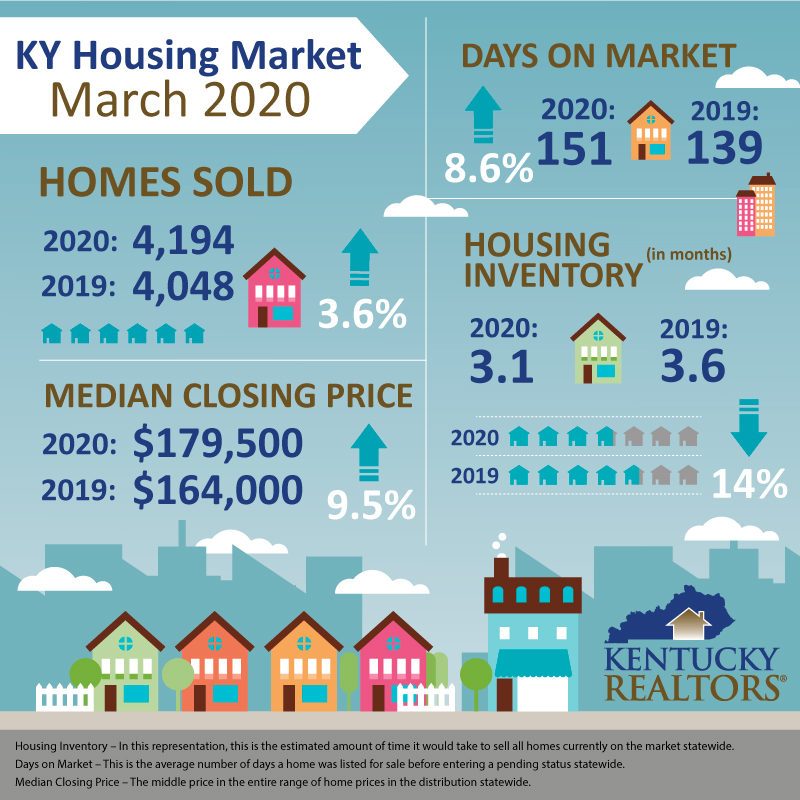

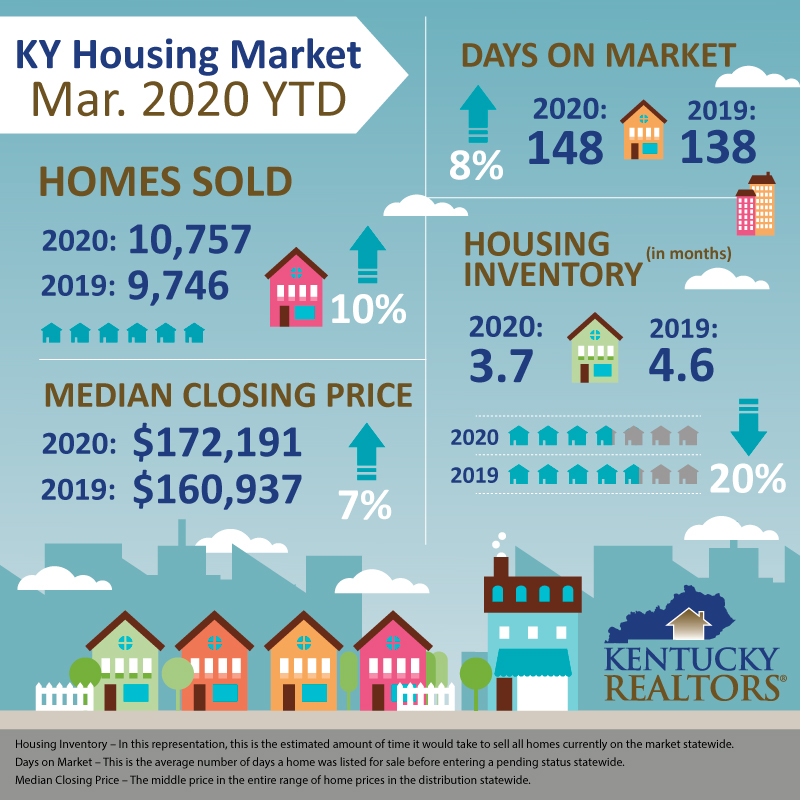

The Kentucky housing market continued its strong start despite March being the beginning of the “COVID-19 season”. March home sales were up 3.6% over last year cresting at 4,194 (up from 4,048). Sales volume in March continued to climb, reaching $884.7 million. This bested the March 2019 figure of $773.9 million by nearly 15%.

Nationwide existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, dropped 8.5% from February to a seasonally adjusted annual rate of 5.27 million in March. Despite the decline, overall sales increased year-over-year for the ninth straight month, up 0.8% from a year ago (5.23 million in March 2019).

“Unfortunately, we knew home sales would wane in March due to the coronavirus outbreak,” said Lawrence Yun, NAR’s chief economist. “More temporary interruptions to home sales should be expected in the next couple of months, though home prices will still likely rise.”

Any slowdown Kentucky may experience in the housing market most likely won’t affect prices. The March figures show that the rising median prices are still on their upward trajectory. The median sale price (month-over-month) in Kentucky rose once again in March. It was up almost 10% at $179,500, up from $164,000 just one year ago. The March year-to-date median price is $172,191.

Sales volume was up significantly for the third month in a row. It swelled 14% in March reaching $884.7 million. This was up from $773.9 million in March of 2019.

“REALTORS® have adapted quickly to a changing marketplace over the last few weeks”, said Lester T. Sanders, President of Kentucky REALTORS®. “Virtual showings, procedural changes, and following CDC, state and local guidelines for safety have helped clients continue buying and selling their homes. REALTOR® best practices have softened the impact that a fearful reaction to the pandemic might have had on the housing market in Kentucky.”

“REALTORS® have adapted quickly to a changing marketplace over the last few weeks”, said Lester T. Sanders, President of Kentucky REALTORS®. “Virtual showings, procedural changes, and following CDC, state and local guidelines for safety have helped clients continue buying and selling their homes. REALTOR® best practices have softened the impact that a fearful reaction to the pandemic might have had on the housing market in Kentucky.”

The number of homes available on the market is dwindling ever further. That inventory figure continues to flirt with the sub-three-month mark. The March 2020 level of 3.1 months of inventory (down 14% over March 2019) remains well below the ideal level of a 6-month supply.