The aggregate volume in pending home sales contracts for the state of Kentucky reached a record high last month. $2.2 billion in transactions were under contract in April 2021. This is up 47% over the $1.5 billion in pending sales volume for both April 2020 and 2019. Home sales numbers continue to be up year-over-year, but the meteoric rise in volume is largely due to the higher prices that the current housing market is commanding.

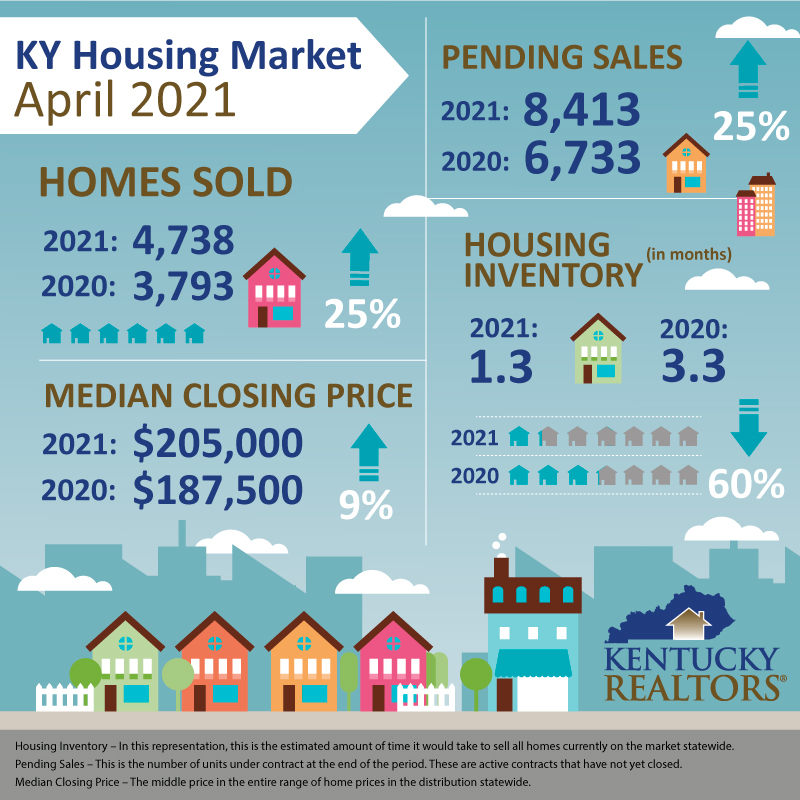

As expected, closed sales are up once again. In April, 4,738 homes sold. This is up 25% from 3,793 in April of 2020. The pending sales count was also up 25%, reaching 8,413 for the month.

As expected, closed sales are up once again. In April, 4,738 homes sold. This is up 25% from 3,793 in April of 2020. The pending sales count was also up 25%, reaching 8,413 for the month.

Nationally, existing-home sales waned in April, marking three straight months of declines, according to the National Association of Realtors®. All but one of the four major U.S. regions witnessed month-over-month drops in home sales, but each registered double-digit year-over-year gains for April. The Southern region accounted for 44% of all existing home sales across the nation.

“Home sales were down again in April from the prior month, as housing supply continues to fall short of demand,” said Lawrence Yun, NAR’s chief economist. “We’ll see more inventory come to the market later this year as further COVID-19 vaccinations are administered and potential home sellers become more comfortable listing and showing their homes. The falling number of homeowners in mortgage forbearance will also bring about more inventory.

The median sale price of homes in Kentucky for April was up about ten percent, to $205,000. Year-to-date, Kentucky’s median sale price is up almost twelve percent at $198,000.

“Across the Commonwealth, and the entire nation, housing inventory continues to be the main factor in both rising prices and the speed at which homes are going under contract”, said Charles Hinckley, President of Kentucky REALTORS®. “We encourage anyone considering listing a home for sale to consult with a REALTOR® to learn about all options available and how the market will react to their particular property.”

Kentucky REALTORS® C.E.O. Steve Stevens says that although this market pace is not sustainable for the long term, experts are not anticipating a crash. “Most economists agree that rising mortgage rates, more homes being added to the market, and slightly waning buyer demand will eventually lead to a market correction”, he said. “This should moderate prices and bring home ownership back into reach for those who might have been priced out of the market in recent months.”