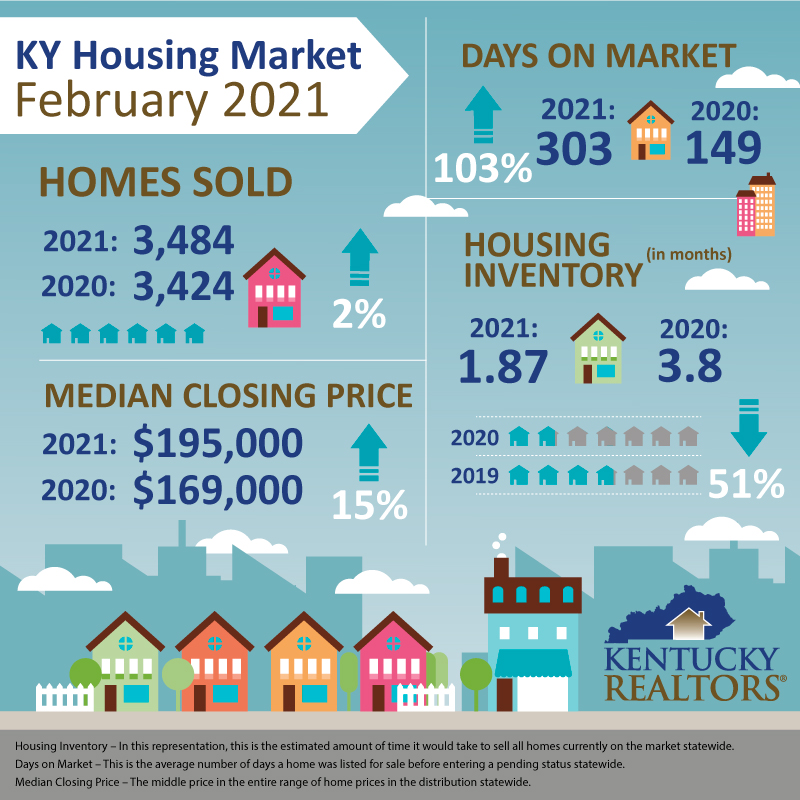

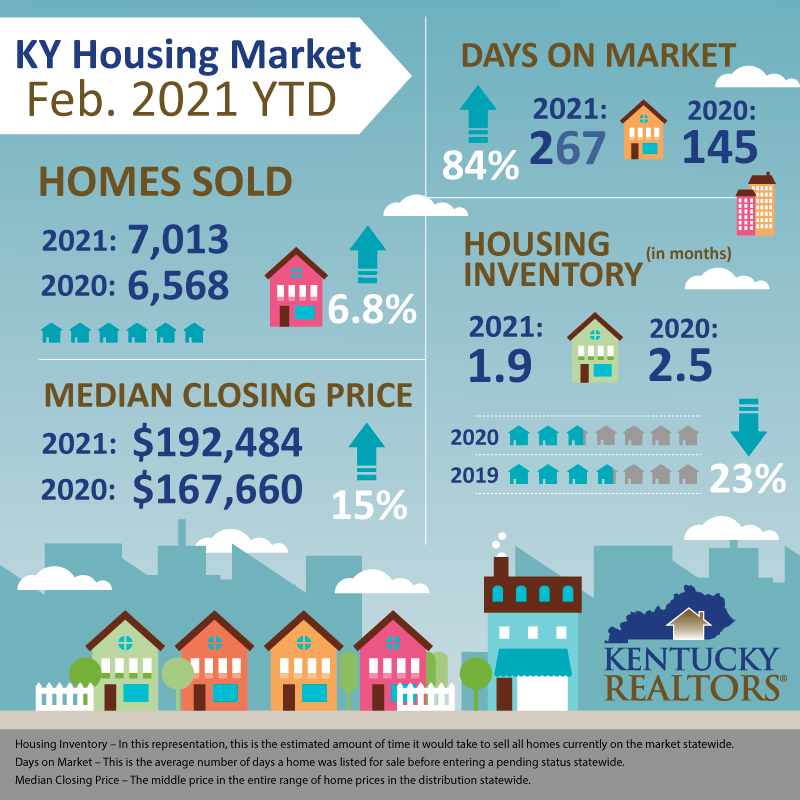

The low inventory in Kentucky’s housing market, along with slowly rising mortgage interest rates, is finally influencing the sales boom we have experienced since May of 2020. February closings topped out at 3,484, up just below 2% from February of 2020 (3,424).

Nationally, pending home sales dipped for a second straight month in February, according to the National Association of Realtors®. Each of the four major U.S. regions witnessed month-over-month declines in February, while results were mixed in the four regions year-over-year. The Pending Home Sales Index dropped 10.6% to 110.3 in February. Year-over-year, contract signings fell 0.5%. An index of 100 is equal to the level of contract activity in 2001.

Nationally, pending home sales dipped for a second straight month in February, according to the National Association of Realtors®. Each of the four major U.S. regions witnessed month-over-month declines in February, while results were mixed in the four regions year-over-year. The Pending Home Sales Index dropped 10.6% to 110.3 in February. Year-over-year, contract signings fell 0.5%. An index of 100 is equal to the level of contract activity in 2001.

“The demand for a home purchase is widespread, multiple offers are prevalent, and days-on-market are swift, but contracts are not clicking due to record-low inventory,” said Lawrence Yun, NAR’s chief economist. “Only the upper-end market is experiencing more activity because of reasonable supply,” he continued. “Demand, interestingly, does not yet appear to be impacted by recent modest rises in mortgage rates.”

The median sale price of homes in Kentucky for February was up once again. The figure of $195,000 was a 15.4% increase over the $169,000 we saw in February of 2020. The statewide average home price in Kentucky has now been above $200k for twelve consecutive months. It rose almost 16% over last February topping out at $228,961. Sales volume numbers are still posting large gains as February saw that figure surge again to just under $800 million, up 18% from $667 million last February.

“While buyers are keeping an eye on rising mortgage rates, there is still a huge demand for properties out there”, said Steve Stevens, CEO of Kentucky REALTORS®. “We’re hopeful that the spring thaw will bring some new sellers into the market.”

“Folks may have been waiting for the best time to sell to get the most equity out of the property they have cared for so far”, said Charles Hinckley, President of Kentucky REALTORS®. “A housing market like this one offers Kentuckians, who may have been on the fence about whether to sell, the opportunity to get creative about their future. Cashing in on the wealth-building that homeownership provides is helping to start writing new chapters for some sellers.”

“Folks may have been waiting for the best time to sell to get the most equity out of the property they have cared for so far”, said Charles Hinckley, President of Kentucky REALTORS®. “A housing market like this one offers Kentuckians, who may have been on the fence about whether to sell, the opportunity to get creative about their future. Cashing in on the wealth-building that homeownership provides is helping to start writing new chapters for some sellers.”

Just 13 homes sold as distressed in February. Consumers facing the prospect of foreclosure may now have would have more time before facing foreclosure under rules proposed this week by the Consumer Financial Protection Bureau. The set of proposed rules, which the regulator will seek public comment on, is intended to give both servicers and borrowers the “tools and time” needed to prevent a deluge of foreclosures.