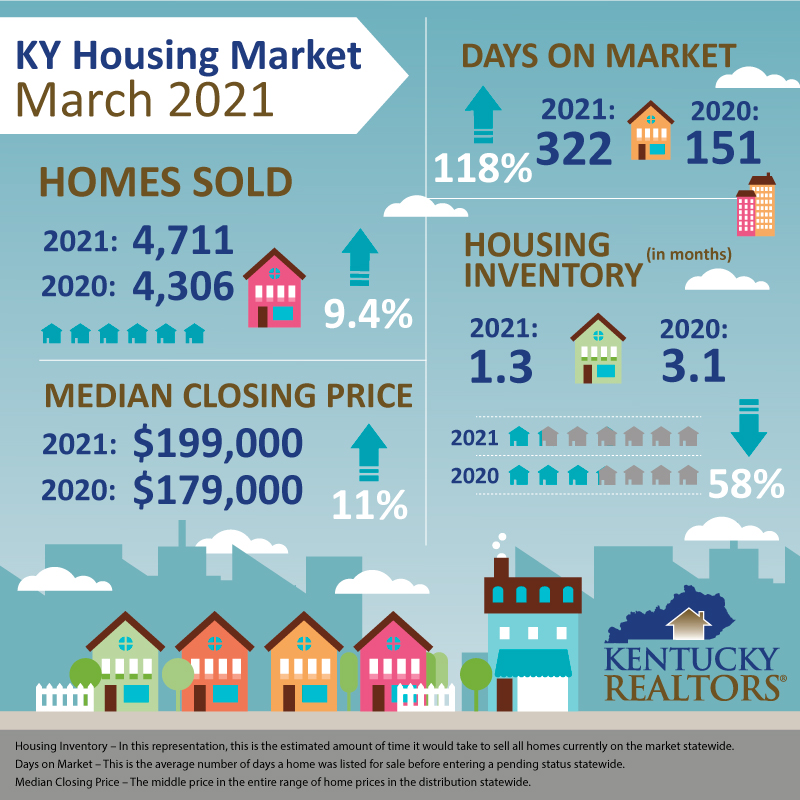

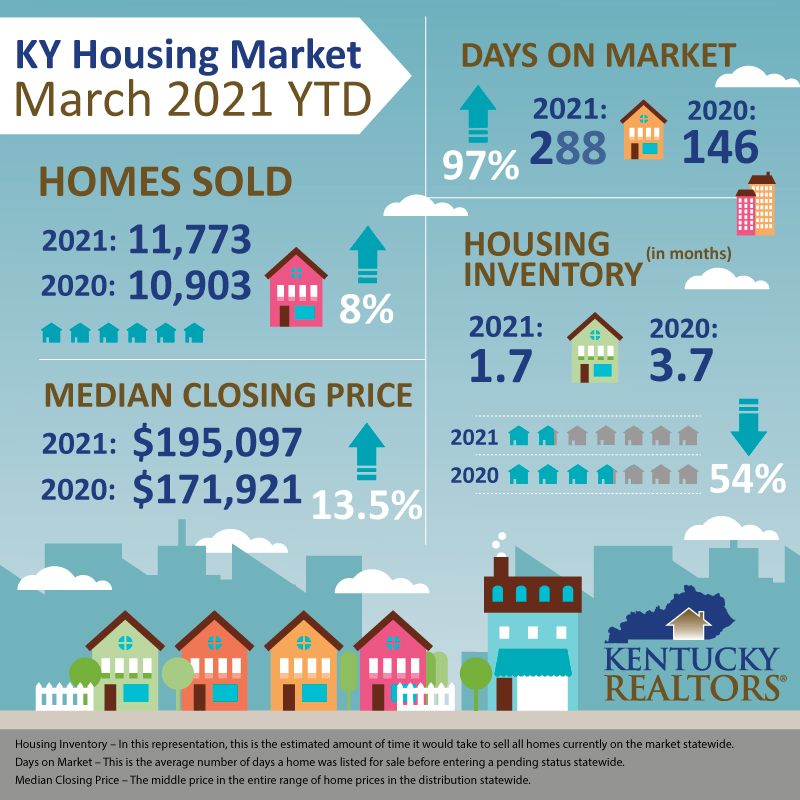

The year-over-year sales number increase marathon continues. The only factor currently lurking that might threaten continued growth is the lack of homes hitting the market. The month of March saw 4,711 closings in Kentucky, up over nine percent from one year ago. (4,306).

The year-over-year sales number increase marathon continues. The only factor currently lurking that might threaten continued growth is the lack of homes hitting the market. The month of March saw 4,711 closings in Kentucky, up over nine percent from one year ago. (4,306).

Existing-home sales fell in March, marking two consecutive months of declines, according to the National Association of Realtors®. The month of March saw record-high home prices and gains. Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums, and co-ops, decreased 3.7% from February to a seasonally adjusted annual rate of 6.01 million in March. Sales overall climbed year-over-year, up 12.3% from a year ago (5.35 million in March 2020).

“Consumers are facing much higher home prices, rising mortgage rates, and falling affordability, however, buyers are still actively in the market,” said Lawrence Yun, NAR’s chief economist. “The sales for March would have been measurably higher, had there been more inventory,” he added. “Days-on-market are swift, multiple offers are prevalent, and buyer confidence is rising.”

The median sale price of homes in Kentucky for March was up once again. At $199,000, the median closing price was up about 11% over March of 2020 ($179,000). The statewide average home price in Kentucky jumped to $235,653. This is an increase of just under 12% over March of 2020 and about $7k over the average price in February of this year. Sales volume numbers are still swelling. March saw that figure rise to $1.11b statewide. This is up 22% from March of last year, and over 30% from March 2019.

Pending sales are up 21% over last March indicating a strong spring selling season. “Inventory remains the key factor in how the market will perform into the summer”, said Charles Hinckley, President of Kentucky REALTORS®. “We’re hopeful that an influx of new sellers, as well as some new home construction, will give Kentuckians more homes to choose from as they relocate.”

Pending sales are up 21% over last March indicating a strong spring selling season. “Inventory remains the key factor in how the market will perform into the summer”, said Charles Hinckley, President of Kentucky REALTORS®. “We’re hopeful that an influx of new sellers, as well as some new home construction, will give Kentuckians more homes to choose from as they relocate.”

Just 13 homes sold as distressed in March, matching the figure from February. This number continues to hover at record-low levels due to the various recourse offered to homeowners behind on payments due to the pandemic.