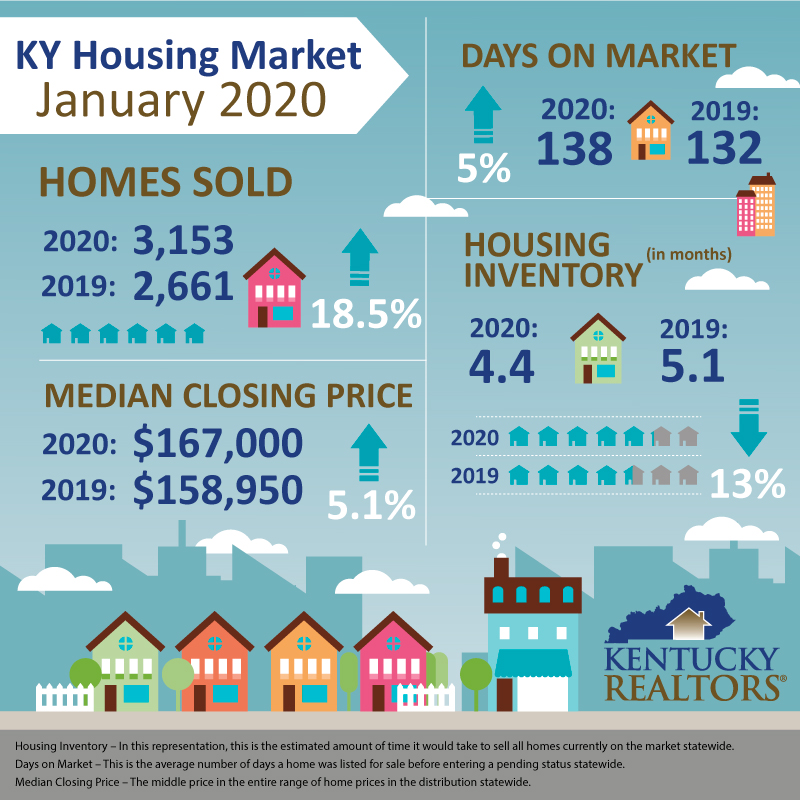

2020 is off to a great start with home sales jumping 18.5% over January of 2019. The closings figure reached a record high for the month at 3,153 homes sold, compared to 2,661 in January of 2019.

For the second straight month, overall nationwide sales substantially increased year-over-year, up 9.6% from a year ago (4.98 million in January 2019). Lawrence Yun, NAR’s chief economist, finds the outlook for 2020 home sales promising. “Existing-home sales are off to a strong start at 5.46 million.” Yun said. “The trend line for housing starts is increasing and showing steady improvement, which should ultimately lead to more home sales.”

The median sale price (month-over-month) in Kentucky for January was up 5.1% at $167,000. In 2019, that figure reached 158,950. The median price has been steadily climbing as low-inventory figures in urban markets continues to act as a barrier to buyers making a move. Sellers continue to find the median sale price reaching 98% of the median listing price ($170,000) across the state.

The median sale price (month-over-month) in Kentucky for January was up 5.1% at $167,000. In 2019, that figure reached 158,950. The median price has been steadily climbing as low-inventory figures in urban markets continues to act as a barrier to buyers making a move. Sellers continue to find the median sale price reaching 98% of the median listing price ($170,000) across the state.

January’s days-on-market (DOM) figure rose just under 5% over last year’s mark to 138 days. Another month-over-month increase comes as a relief to property owners who may have been waiting a bit longer to enter a pending status. With a shortage of homes entering the market, low inventory continues to affect affordability and buyer flexibility.

Sales volume was up significantly in January. A 21% increase in volume means total sales reached $11.15 million, compared to $9.9 million in January of 2019). Lester Sanders, President of Kentucky REALTORS®, says that rising prices are definitely impacting the economy. “With prices steadily climbing, the amount of dollars within the record number of transactions is noteworthy”, he said. “We continue to watch for any signs of a slowdown, but so far it looks like we could continue to see record-breaking statistics as we head into the warmer months.”

Homes available for sale remain under the ideal level of a 6-month supply. The January figure of 4.4 months of inventory is down 13% from last year’s figure of 5.1 months. This market condition is expected to persist through 2020.