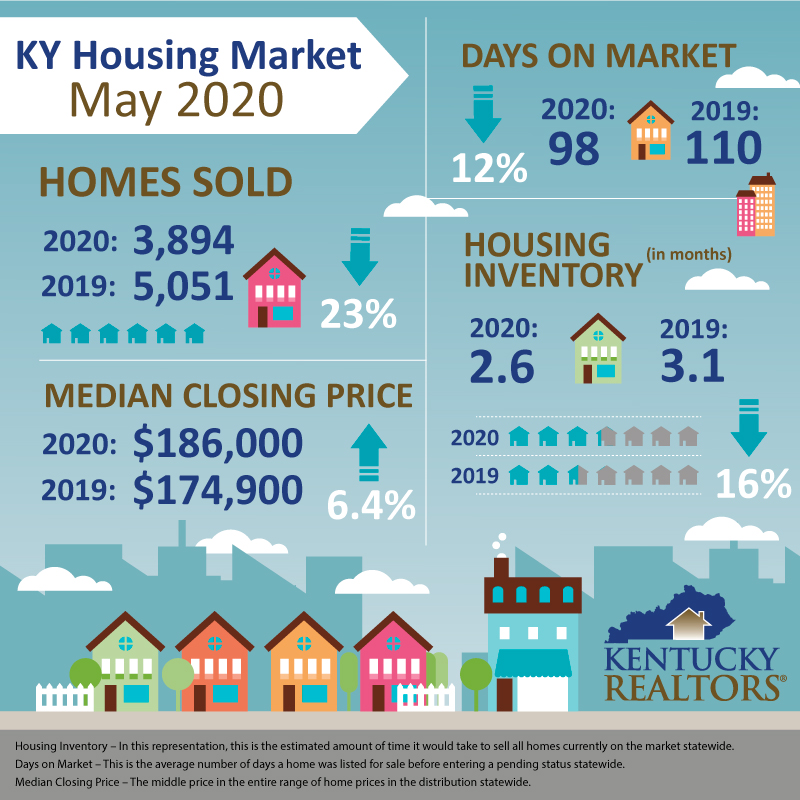

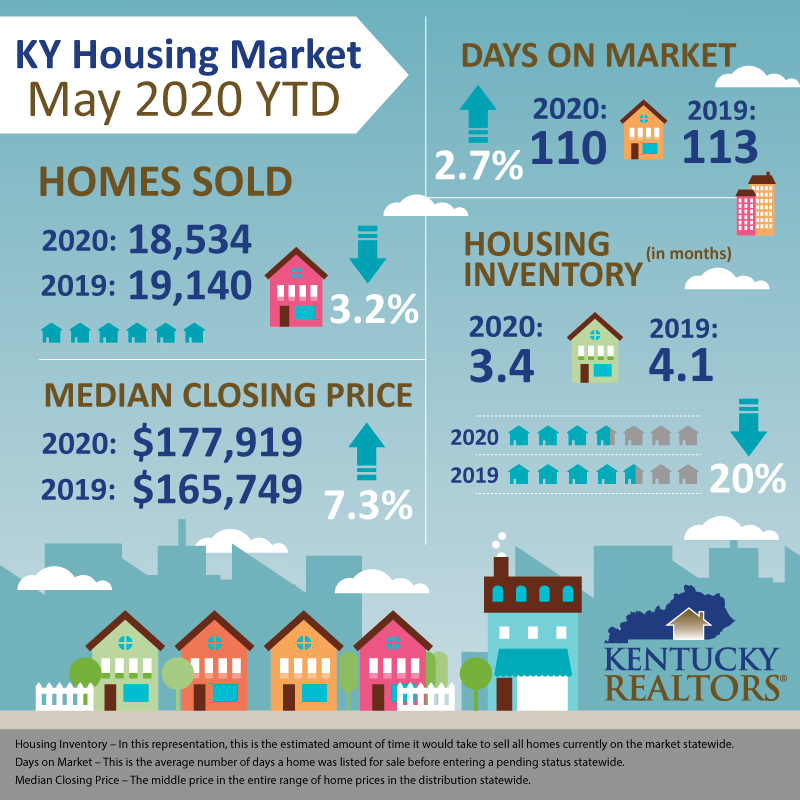

Home sales numbers were down as expected in May. 3,894 closings took place, down 23% from the 5,051 homes sold in May of 2019. The best way to measure what the next month will look like, however, is to look at pending sales (homes under contract). Last year, that figure for May was 7,311. This May saw that indicator rise by over 16% to 8,511. This indicates that June could emerge much stronger.

Home sales numbers were down as expected in May. 3,894 closings took place, down 23% from the 5,051 homes sold in May of 2019. The best way to measure what the next month will look like, however, is to look at pending sales (homes under contract). Last year, that figure for May was 7,311. This May saw that indicator rise by over 16% to 8,511. This indicates that June could emerge much stronger.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, rose an astounding 44.3% to 99.6 in May, chronicling the highest month-over-month gain in the index since NAR started this series in January 2001. Year-over-year, contract signings fell 5.1%. An index of 100 is equal to the level of contract activity in 2001.

“This has been a spectacular recovery for contract signings and goes to show the resiliency of American consumers and their evergreen desire for homeownership,” said Lawrence Yun, NAR’s chief economist. “This bounce back also speaks to how the housing sector could lead the way for a broader economic recovery.

The average sale price of homes in Kentucky continues to rise. It climbed 4% to $215,187 (up from $207,000 in April 2019). Sales volume did take a hit, dipping 20%. to $837.9 million. However, the surging home prices due to the current lack of inventory is keeping the volume numbers impressively ahead of last year’s numbers. Even with the sale slowdown of the past 2 months, the year-to-date sales volume is 2.5% ahead of 2019 at $3.8 billion.

The number of homes available on the market hit an all-time record low for the state, plunging to 2.6 months of inventory. It was down over 16% from May of 2019 (3.1 months).

The number of homes available on the market hit an all-time record low for the state, plunging to 2.6 months of inventory. It was down over 16% from May of 2019 (3.1 months).

“KYR’s May Opinion Survey showed that 59% of Kentucky REALTORS® saw buyers returning to the market last month”, said Lester T. Sanders, President of Kentucky REALTORS®. “Currently, consumers don’t have enough options on the market. It’s a great time for homeowners who have considered selling to list their homes”, he said. “Multiple offer situations are becoming the rule rather than the exception.”

Strikingly, distressed sales (foreclosures or short sales) were down a remarkable 65% over May of 2019. This suggests that homeowner protection programs such as mortgage forbearances or loans are accomplishing what they were intended to do.